Excerpt from a recent 2025 WSJ article says private equity investors are facing significant challenges, with a growing number of unsold companies and delayed exits. The ratio of PE investments to exits reached over 3 times in 2025, the highest in a decade. This situation is causing private equity firms to lock investors' money in aging “zombie funds” with no clear exit in sight.

I remember several years ago trying to collect a late overdue payment from a long-term customer that had just been purchased. The new ownership was ignoring me until I showed up in person at their door. I was told that they had purchased the company's assets but not their liabilities, meaning they didn't have to pay for the labels that they were using to ship their products. How in this world can that be legal?

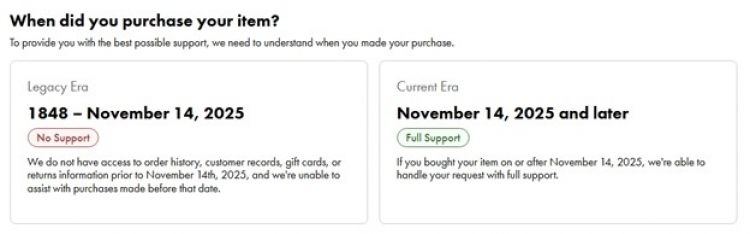

Fast forward to last week when I contacted a famous 178-year-old catalog company. They had always boasted of offering a lifetime warranty for their products. Over the years I had become a loyal customer knowing that I was paying more but was willing to do so for the lifetime guarantee. After contacting them asking where I could try to find a transformer for my blown Christmas tree lighting, their response was that the new company only purchased the brand name. They didn't purchase the operations, warranties, or anything else - just the name and the customer list. Below is a picture clipped from their website earlier today. If you purchased a product from them from 1848 to November 14th, 2025, and you need support or warranty information you're out of luck.

Why on earth would anyone purchase from them knowing their private investment owner is simply looking for profit and will unload the company in the future? When you've been bitten once by a company, why would you go back for more? In the case of the 178 year-old catalogue company I'll still receive their catalogs, only this time Google offers a nifty tool called pixel search which allows us to take a picture of any item and the search function will return several options to purchase. I don't think the private investors realize this which is why I give them two or three years of survival. A lot of people stand to lose money in this investment, as they get tied up in another “zombie fund”.

Another example where investors are going to lose money is in the case of one of my long-term larger customers who was initially purchased by their main competitor then gobbled up by a private investment company. After some of their accounts started jumping ship, management held a board meeting. One of the officers said, “we appear to have lost our family business customer service touch; what can we do to get it back”. The response to him by one of the original employees was “you're never getting it back, it's too late, you killed it.” After a decade the merger still has not functioned as they had planned as there's still a lot of overlap and redundancies within their corporation, as well as a lack of employee morale.

A lot of these investment companies with deep pockets think they're going to take over companies that have built long term legacies with a family-owned feel and make them better to turn a profit and resell them. Little do they know there are a lot of industry nuances, certain management nuances, and contacts built over years of friendships, goodwill, and loyalty that drive companies to succeed. Time and time again, particularly in my industry, I hear from owners and friends who have sold out particularly during the COVID times only to learn they won't be getting the cash that they had thought. In one case a friend who owned a company for 35 years told me the new ownership was only interested in reading spreadsheets. He struck a deal that involved company stock rather than cash and had planned on retiring 2 years ago. As of today, he's still working for them trying to get the stock price up to a point where he can retire. Immediately after the sale, employee morale went down the tubes, and the company started shedding accounts. Again, the family feel and the legacy that he had built over the years was never coming back. Private equity investment killed it. How many former small business owners regret selling their family businesses to investment outfits only to see their business, employee morale, and customer loyalty killed overnight?

Next time you hear people talking about how service nearly everywhere has deteriorated, that nobody seems to care, and the world is not like it used to be, chances are it's because private equity investment killed it.

Published: